What Does Mortgage Broker Do?

Wiki Article

How Mortgage Broker can Save You Time, Stress, and Money.

Table of ContentsWhat Does Mortgage Broker Mean?Little Known Questions About Mortgage Broker.All About Mortgage BrokerIndicators on Mortgage Broker You Should KnowGetting My Mortgage Broker To WorkMortgage Broker Can Be Fun For Everyone

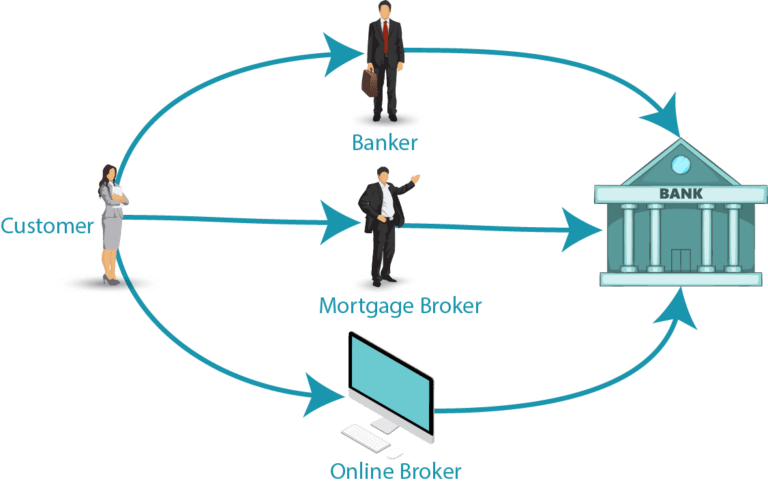

They can undergo all their loan provider partner's programs to locate the best suitable for you, as well as ideally the finest pricing as well. As an example, they might discover that Financial institution An uses the most affordable price, Financial institution B uses the most affordable closing expenses, and Bank C has the best possible mix of rates and fees.

And who wishes to request a mortgage greater than once? The number of banks/lenders a home mortgage broker has accessibility to will certainly vary, as brokers should be authorized to function with each independently. Someone who has actually been in business a long period of time may have developed a multitude of wholesale companions to pick from.

The 8-Minute Rule for Mortgage Broker

They may additionally advise that you limit your financing total up to an adhering quantity so it abides by the standards of Fannie Mae and also Freddie Mac. Or they might suggest that you break your loan into a first and also bank loan to avoid mortgage insurance and/or obtain a far better mixed rate - mortgage broker.For instance, if you have poor credit report or are a real estate investor, brokers might have wholesale mortgage partners that concentrate on home loan just for you (mortgage broker). Yet they might not work with the retail level, so you 'd never know regarding them without your broker liaison. A retail financial institution might simply offer you common funding choices based on the finance application you submit, without any kind of more insight in terms of structuring the offer to your advantage.

Not known Facts About Mortgage Broker

If you recognize you're looking for a details kind of finance, seeking out one of these specialized brokers can lead to a better end result. They might also have companions that stem big home loans, thinking your financing quantity goes beyond the adhering lending limit. When all the information are ironed out, the broker will send the loan to a lender they function with to gain approval.What they charge can vary substantially, so make certain you do your homework before concurring to work with a home mortgage broker. Mortgage Brokers Were Condemned for the Real Estate Situation, Brokers obtained a lot of flak for the recent real estate crisis, Specifically considering that agented residence financings exhibited higher default prices, Family member to house fundings originated using the retail financial network, However inevitably they only resold what the banks were using themselves, Home mortgage brokers were largely condemned for the home mortgage site dilemma due to the fact that they came from fundings on behalf of various banks as well as weren't paid based on loan performance.

Per AIME, brokers have traditionally not been given the recognition they should have for being experts in their area. Mortgage Broker FAQLike all various other financing producers, brokers bill source fees for their solutions, as well as their costs might vary widely. It sets you back money to run a home loan brokerage, though they might run leaner than a huge financial institution, passing the cost savings onto you.

Mortgage Broker - Questions

If they aren't billing you anything straight, they're simply getting paid a broker commission by the lending institution, suggesting you'll wind up with a higher rates of interest to make up. Make sure to discover all alternatives to get the finest combination of rate and fees. Not necessarily; as stated home loan brokers can supply competitive rates that meet or beat those of retail financial institutions, so they should be thought about along with banks when browsing for funding.In addition, brokers must normally complete pre-license education and some must secure a bond or fulfill particular web well worth requirements. Yes, home mortgage brokers are image source regulated on both the federal and state level, as well as have to adhere to a big number of regulations to conduct company. Additionally, consumers have the ability to seek out broker records through the NMLS to ensure they are accredited to conduct business in their state, as well as to see if any kind of activities have actually been taken versus them in the past.

And also despite the ups and downs that include real estate, they will probably remain to play an active role in the mortgage market since they supply a distinct service that large banks and also lending institution can't copy. So while their numbers may fluctuate periodically, their solutions must constantly be available in one method or an additional.

The smart Trick of Mortgage Broker That Nobody is Discussing

Utilizing a home mortgage broker such as not just makes audio economic feeling, yet will certainly offer you with all kinds of important help. So, you're looking for home loan offers to help you purchase a building, however with a lot of mortgage companies and mortgage lenders out there, it can be tough to understand where to start.Besides, there learn this here now are so lots of costs involved with acquiring as well as moving house or remortgaging. However attempting to do without a home mortgage broker would be a mistake as mortgage broker advantages are clear. Utilizing a home loan broker such as Finance. co.uk not only makes audio monetary feeling, however will certainly supply you with all kind of crucial help.

Save you cash A mortgage broker will comb the readily available mortgages for you and look into the most effective bargains. This isn't just a situation of trying to find the most affordable home loan rates today, or the cheapest tracker home loan or cheapest fixed price mortgage. A knowledgeable home loan broker has the ability to look past the mortgage rate of interest to take into account all the various other costs that will apply.

Examine This Report about Mortgage Broker

4. Offer you expert financial suggestions Home loan brokers have to be certified to assist you find a home loan and also offer you economic suggestions. They are likewise have a task of treatment to offer you the best advice they can, instead of just press the option that will certainly provide the most appoint.Care for the application documents The world of mortgage funding has lots of jargon as well as tedious documentation, but the specialists at Lending. co.uk will take care of all that tough job for you. They'll prefill your mortgage application for you so your new mortgage can go as efficiently as feasible.

Report this wiki page